Is the proportion of how much you spend on or buy making improvements contrasted to just how much the enhancements deserve to somebody who has an interest in buying your residence. Rocket Home mortgage Ⓡ partners with home mortgage brokers across the nation to aid you find the most effective home mortgage for your situation. Contrasts how much you borrow with the value of the home you're obtaining versus. It's computed as the total up to be borrowed divided by the house's worth and is usually expressed as a percentage.

- Fixed-rate loans provide a predictable settlement every month, which makes budgeting easier.

- There are a variety of choices if you're in the marketplace for no down payment home loans.

- Specified revenue financings were made unlawful in 2010 by the Dodd-Frank Wall Road Reform as well as Consumer Defense Act.

A healthy and balanced monetary circumstance means you aren't drowning in the red, so a reduced DTI is liked. Generally, customers with DTI over 43% are taken into consideration riskier, although there are exceptions made. Lenders can accept borrowers check here with DTI as high as 47% utilizing details mortgage programs. If you are aiming to obtain the lowest rates of interest, you ought to consider the type of Selling A Timeshare Without Upfront Fees car loan you'll utilize, your certifying factors, as well as the problem of the market.

Why Your Credit Score Issues When Getting A Residence

A certification of completion is required when you utilize a financing for home restoration or for the building of a brand-new residence. Is a person that is certified to handle residential property purchases and also who functions as an arbitrator for purchasers as well as sellers. The quantity funded depends upon whether you make greater than minimal repayments.

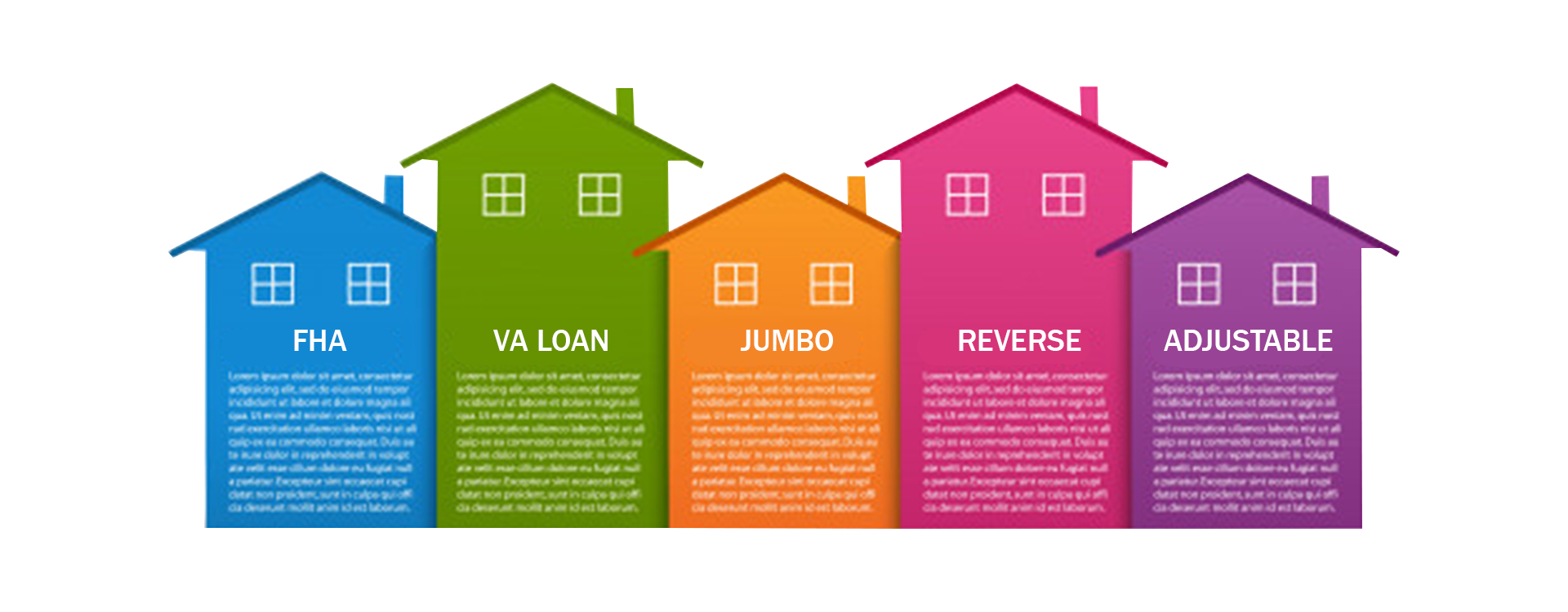

For non-first-time home-buyers, there is a limit of 80% of LTV on brand-new home mortgage loaning, whatever the value of the home, so you will require a deposit of 20% of the complete acquisition rate. These limitations relate to many housing financings including equity release and top-up on a present home loan. Yet, they do not put on switcher home loans, or to the restructuring of home mortgages behind or pre-arrears. These car loans make it easier for veterans of the united state armed forces, and also in some cases their spouses, to get homes.

Price Lock

Victoria Araj is an Area Editor for Rocket Home loan and also held duties in mortgage banking, public relations as well as even more in her 15+ years with the company. A variable rate is a rate of interest that transforms occasionally in connection with an index. A title search is an examination of local property records to guarantee that the vendor is the lawful owner of a property and that there are no liens or other claims versus the building. Under the arrangements of the Truth-in-Lending Act, the right to rescission is your right to cancel certain kinds of financings within 3 days of authorizing a home mortgage. Is a realty agent who belongs to the National Association of REALTORS ®. A non-assumption clause is a declaration in a home loan agreement that forbids the transfer of the mortgage to one more debtor without the prior authorization of the loan provider.

With that in mind, as opposed to looking at how the lending plays out over thirty years, let's consider what Lending An and also Finance B would cost you in rate of interest earlier in the home mortgage's lifetime. Focusing solely on your home mortgage rate sidetracks you from the real cost of the car loan-- Timeshare Cmo as well as it can be a pricey mistake. A down payment of 10% to 20%, although some car loan programs will certainly enable you to make little to no deposit. Small-dollar home loans are available at choose lenders, in addition to via nonprofits and also government firms.

You can decrease the rates of interest on your mortgage by paying an up-front cost, called home mortgage factors, which ultimately reduce your monthly payment. One point equates to 1 percent of the expense of your home mortgage and buying one factor generally reduces your interest rate by 0.125 percent. This way, getting points is stated to be "buying down the rate." Factors can also be tax-deductible if the purchase is for your key house. If you plan on living in your following residence for a minimum of a decade, then factors could be a great choice for you.